Mobile Banking

Available to all FMBank customers enrolled in Online Banking, you can quickly check your account balances, review transactions history, transfer funds, pay bills, find the closest ATM and more with just a few taps.

With FMBMobile, you have the convenience of viewing account balances, transferring funds, and receiving balance alerts all through the Internet on your cell phone. (Note: FMBMobile is free to our Online Banking customers but does require a mobile phone with Internet data service capabilities. See your mobile phone carrier for details; additional carrier fees may apply.)

Three Ways to Bank Mobile

- APP – Download the FMBank mobile app today for easy access to your account information, pay your bills, transfers funds, or even make a deposit.

- TEXT – Text Banking is a fast, easy way to check your account balances or your transaction history on the go. Activate within your Online Banking and you’ll have access to the latest transaction information with just a few keywords.

- WEB – Access Mobile Web Banking via your browser on your phone or tablet.

FMBank MOBILE Banking (for iPhone, iPad or Android device) & Checkfree Bill Payment is now AVAILABLE in iTunes & Google Play!

Android App Download |

iPhone App Download |

iPad App Download |

Mobile Banking Security

- 128 Bit Encryption

- Your login information is not stored on the device

- Automatic inactivity logout

- Your account numbers are masked

- The same security you are accustomed to with Online Banking

Additional Security

We recommend for additional security that you set up a password or PIN on your phone. This protects you against use in the event your phone is lost or stolen. Do not share your password or PIN with anyone.

- Make sure that you keep your mobile software up to date.

- Make sure you do not respond to text messages or emails requesting personal information.

- Do not click on any links within emails or text messages requesting personal information.

- Do not download files or click on attachments. Always check with the respective party to see if they sent you something or go to the Company’s website using another device to check the information.

FMBank will never request confidential information about you or your accounts via email, text, or other electronic communication. We will not request you verify information about your account or other personal information via an email, link, text message or voice message. If you receive such a message or have any questions about information requested from FMBank, please contact us immediately at 662-365-1208.

For more information about FMBank Mobile Banking, please contact us today!

Mobile Deposit

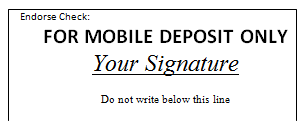

FMBank Mobile Deposit can be used to deposit most checks that are payable to you and drawn on a US financial institution; including personal checks, business checks and government checks. You must endorse each check with the words “FOR MOBILE DEPOSIT ONLY ” and your SIGNATURE prior to taking a picture of the check.

You may submit FMBank Mobile Deposits at any time and make as many deposits as you need each business day up to a daily limit of $10,000. If the Mobile Deposit transaction rejects, you will be notified and you may choose to re-deposit the check using another method such as: a branch, by mail, or at an FMBank ATM.

Mobile Deposit funds are generally available the next business day after the business day of your deposit, unless a hold is placed. If a hold is placed, you will be notified. A Mobile Deposit submitted before the cut-off time of 4:00PM Central Time on a business day will be processed that day. A Mobile Deposit submitted after 4:00PM Central Time will be processed on the next business day. Business days are defined as Monday-Friday excluding holidays that the Bank is closed.

After you have received confirmation that your Mobile Deposit has been accepted for deposit, you should mark the check as having been deposited and store it in a secure place. You should keep checks for a Retention Period of 5 days after deposit in case the original check is needed for any reason. Remember to destroy your checks in a secure manner after 5 days.

Step-by-step instructions

TAP

- Log into FMBank Mobile app from your phone or tablet

- Click “Deposit” > Deposit A Check

- Select the account for deposit.

DEPOSIT

- Enter the check amount.

- Endorse the back of the check:

FOR MOBILE DEPOSIT ONLY & YOUR SIGNATURE

SNAP

- FRONT IMAGE: Take photo check front.

- BACK IMAGE: Take photo check back.

- Click “Confirm”

- Answer security challenge question

- Click View My Accounts to Exit

Quick Tips:

- You must be enrolled in our Internet Banking and have the mobile app downloaded to a camera ready device in order to use this service

- Sign the back of your check as it appears on the front. Write “FOR MOBILE DEPOSIT ONLY and YOUR SIGNATURE”. Use black or blue ink.

- Place check on a dark, flat surface for best results.

- Keep hands clear of the check when photographing.

- Make sure the check is not folded or torn.

- Make sure the amount entered matches the written amount on the check.

- To protect against duplicate deposits, write "Electronically Deposited on {date}" across top of check AFTER receiving accepted notification.

- For a complete list of checks that are not eligible for mobile deposit such as foreign banks or other non-check items etc., contact us at 662-365-1208.

If you need assistance or have questions, please contact us at 662-365-1208 or visit you local branch.

Online Banking

Our Online Banking and Bill Payment Service at www.fmbms.com are the future of banking…today! Online Banking allows you to access account information, make funds transfers between FMB accounts, review your account transaction history, and obtain the latest information about products and services from any computer with Internet access, anywhere in the world. The Bill Payment service allows you to pay your bills without writing out checks, licking stamps, or stuffing envelopes. Best of all, both services are FREE!

How do I enroll?

Its easy! Fill out the simple enrollment form where we’ll ask you a few questions to get you setup and that's it! You’ll be ready to start managing your finances when it’s convenient for you*.

If you need assistance during this process, give us a call at 662-365-1208. We are here to help!

Existing users

If you are an existing user and having trouble with Online Banking, please call us at 662-365-1208 for assistance during regular business hours. If you have forgotten your password, you can use our Forgotten Password feature on the website.